What is the first thing an injured person can expect after an accident? In many cases it is a call from an insurance claims adjuster.

Many people are generally familiar with the role of the claims adjuster. They are called claims adjusters for a very good reason as it is their job to “adjust” claims on behalf of the insurance company. In other words, their goal is to “adjust” an injury claim by paying a reduced or discounted settlement.

Claims Adjusters serve a very important purpose for the insurance company. If a claims adjuster can convince just one injured person to settle their claim for a low amount, they can save the insurance company thousands of dollars.

But why is it that claims adjusters are interested in settling injury claims quickly?

There are 2 primary reasons why an adjuster will make an early settlement offer. First, the claims adjuster knows that if the injured person hires a well-qualified injury lawyer, the adjuster is going to have to pay a fair and full settlement to get the case resolved.

Second, because most traumatic injuries have longer-range consequences, by settling early, a claim adjuster can get away with paying a lower settlement that does not account for the future impact of the traumatic injury.

_________________________________________________________________________________________________________________________

It is so disappointing to hear stories of people who settled early for a low amount when, years later, they are continuing to have pain, discomfort, and loss in freedom of movement. Once an injured person has signed a settlement release, the case is closed and there is nothing I can do to right a wrong.

Claim Adjuster Tactics

There are a handful of tactics an adjuster will use on an injured person to try and get them to release their claim before the person has had the opportunity to consult with an injury lawyer.

Some claims adjusters will try and gain the trust of the injured person by acting quickly to arrange for a rental car and get the injured person’s car fixed. The adjuster will do this so the injured person will have confidence that the adjuster is going to fully cover the entire claim, including the bodily injury claim.

But remember the property damage claim and the personal injury claim are two separate claims. The personal injury claim is a far more complex claim that largely is influenced by the medical evidence. As a result, legal consultation is very helpful toward understanding the true value of the injury claim.

Another technique claims adjusters use is to make an injured person an offer to pay a small amount of “pain & suffering” money along with an offer to pay the injured person’s medical bills up to some pre-determined amount.

Be very cautious of agreeing to any kind of offer where the adjuster decides how much medical treatment you can have. Not only does this limit your medical and legal recovery, but it also puts limits on your doctor and therapists in the treatment of your injuries. Bad idea all the way around.

Finally, some claim adjusters will tell you that you are going to get less by going with an attorney because the attorney is going to take an attorney fee. If this were the case, personal injury lawyers would have been rendered obsolete long ago.

At a minimum, and injured person should at least consult with an attorney they trust before agreeing to settle a personal injury claim. While there are some cases that can be resolved without the need for an injury lawyer, in the situation where medical treatment and rehabilitation treatment is involved, the injured person is going to make the best medical and legal recovery when protected by legal representation.

About Doug Horn

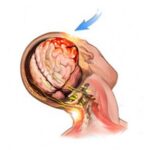

Since 1990, Attorney Doug Horn has focused his law practice on representing injured persons in Missouri, Kansas, and across the Midwest. His areas of concentration include cases involving head, neck, back, and other serious injury requiring extended medical care and rehabilitation. In addition to his law practice, Horn frequently presents to national attorney audiences in the area of personal injury law and litigation.